Teaching financial literacy to inmates can lower recidivism rates by up to 30%. Why? Many former inmates struggle with money management, which increases their chances of reoffending. Programs that teach budgeting, credit building, and banking skills help them achieve financial stability, reducing the need to return to crime.

Key Takeaways:

- Common Financial Challenges: No credit history, lack of bank access, and inability to cover emergencies.

- Program Benefits: Improved access to housing, jobs, and financial inclusion.

- Cost Savings: For every $1 spent on these programs, taxpayers save $4–$5 in reduced incarceration costs.

Financial literacy is a practical, cost-effective way to support reintegration and reduce the overall burden on the justice system.

Research: Financial Education’s Impact on Reoffending

Study Results and Statistics

A study conducted by the University of Arkansas at Little Rock evaluated a financial literacy program tailored for inmates nearing release [5]. The findings were clear: inmates who completed these financial education workshops were less likely to reoffend compared to those who didn’t participate.

The study highlights the role of financial stability in shaping outcomes not only for former inmates but also for their families. This ripple effect extends to the broader economy, making the case for targeted financial education even stronger. The research also points to the importance of understanding which specific program elements drive these positive results.

Program Success Rates

Comparisons between program graduates and non-participants reveal noticeable differences in outcomes. Programs that cover essential topics like basic banking, credit building, and emergency planning help participants overcome common financial obstacles. These efforts lead to better financial inclusion, improved access to housing, and greater resilience.

For example, the Pennsylvania Department of Banking and Securities focuses on teaching practical skills such as managing accounts and building credit, which have proven effective during reentry [3]. Programs that combine theoretical knowledge with hands-on practice tend to yield the best results. Directing participants to credit unions has been especially impactful, as these institutions often avoid the high fees and minimum balance requirements that discourage financial engagement.

The data consistently shows that addressing both short-term financial needs and long-term stability has the greatest effect on reducing recidivism. By emphasizing practical tools and ongoing support, these programs pave the way for smoother reintegration into society.

What Makes Financial Education Programs Work

Money Management Skills Taught

In Pennsylvania’s correctional facilities, outreach specialist Becky MacDicken has created a curriculum that focuses on teaching practical financial skills [3]. These programs cover essential topics like managing accounts, building credit, and budgeting. They also tackle distrust in traditional banking by encouraging participants to consider credit unions, which often have lower fees and fewer hurdles.

Here’s a breakdown of the key financial skills covered in these programs:

| Skill Category | Specific Topics |

|---|---|

| Basic Banking | Account management, ATM usage, Mobile banking |

| Credit Building | Credit reports, Repair strategies, Building credit history |

| Debt Management | Loan types, Interest rates, Debt reduction plans |

| Budgeting | Income tracking, Expense planning, Emergency funds |

Program Scheduling and Support Services

Timing plays a crucial role in the effectiveness of these programs. Research shows they work best when offered prior to release as part of a broader reentry plan [4].

The most impactful programs combine financial education with other reentry services, such as:

- Employment assistance to help participants apply financial skills in workplace settings

- Housing support to navigate the financial steps of securing stable living arrangements

- Counseling services to address both financial and emotional challenges tied to reintegration

These combined efforts help participants turn financial lessons into practical stability, reducing the likelihood of reoffending. Programs like these aim to build confidence in managing money, easing the financial stress many formerly incarcerated individuals experience [3].

Money Saved Through Lower Recidivism

Reduced Prison System Costs

Implementing financial literacy programs in correctional facilities isn’t just about helping individuals; it also significantly reduces costs for taxpayers and the prison system. Research shows that these programs lower reoffending rates, leading to substantial savings.

For every dollar spent on prison education programs, taxpayers save four to five dollars in reincarceration costs, easing the strain on state budgets [2].

Here’s a breakdown of potential annual savings per inmate:

| Cost Category | Annual Savings Per Inmate |

|---|---|

| Direct Incarceration | $40,000 |

| Court Proceedings | $8,000–12,000 |

These savings come from fewer people returning to prison, thanks to the skills and knowledge gained through financial literacy programs. By helping participants achieve economic stability, these programs reduce the overall burden on the justice system.

Program Costs vs. Benefits

When you compare the costs of these programs to the savings they generate, the results are clear: financial literacy initiatives are highly cost-effective. Research from the University of Arkansas at Little Rock supports this, highlighting the economic advantages [4].

"Correctional programming that addresses financial literacy may decrease confusion and issues of financial self-confidence and being overwhelmed in financial situations, which are barriers to positive financial change after release" [3].

These programs don’t require much to implement – just trained instructors and basic materials – making them affordable and easy to integrate into existing educational efforts. This combination of low costs and high returns makes financial literacy programs a smart investment for correctional facilities.

sbb-itb-25113a2

Problems to Solve and Next Steps

Current Program Limitations

Financial literacy programs in correctional facilities face hurdles like tight budgets and a lack of trained staff, which limit their impact. Here’s how these challenges play out:

- Limited funding means fewer participants, shorter programs, and outdated materials or tools.

- Staff shortages, often due to reliance on untrained volunteers, result in inconsistent program quality, minimal individual support, and restricted program coverage.

| Challenge | Impact |

|---|---|

| Limited Program Coverage | Fewer inmates can participate |

| Reduced Individual Support | Less personalized guidance |

| Inconsistent Quality | Varying effectiveness across programs |

| Resource Constraints | Minimal practical training materials |

Overcoming these issues will take focused efforts and fresh approaches.

Steps to Improve Programs

To make financial education more effective, correctional facilities need to adopt specific strategies. According to research by the University of Arkansas at Little Rock, focusing on practical skills and building sustainable program models is key [5].

One promising idea is forming partnerships with financial institutions. These collaborations can teach inmates practical banking skills and help them steer clear of predatory financial services [1]. Programs should also use materials designed for participants’ education levels and financial experiences to ensure accessibility.

By addressing these shortcomings, financial education programs can better prepare inmates for life after release, potentially lowering recidivism rates.

Research Needs

There are still gaps in understanding how to make these programs as effective as possible. The Center for Financial Inclusion highlights several areas that need more exploration:

| Research Priority | Purpose |

|---|---|

| Longitudinal Studies | Track outcomes over time after release |

| Component and Integration Analysis | Identify what works and how to combine reentry services effectively |

| Cost-Benefit Analysis | Assess the return on investment for various program models |

To keep improving, financial literacy programs need solid data. This means looking at how financial education interacts with other reentry challenges and using evidence-based strategies to refine these initiatives [1].

The Power of Education in Breaking the Cycle of Recidivism

Using Impact Justice AI for Reform

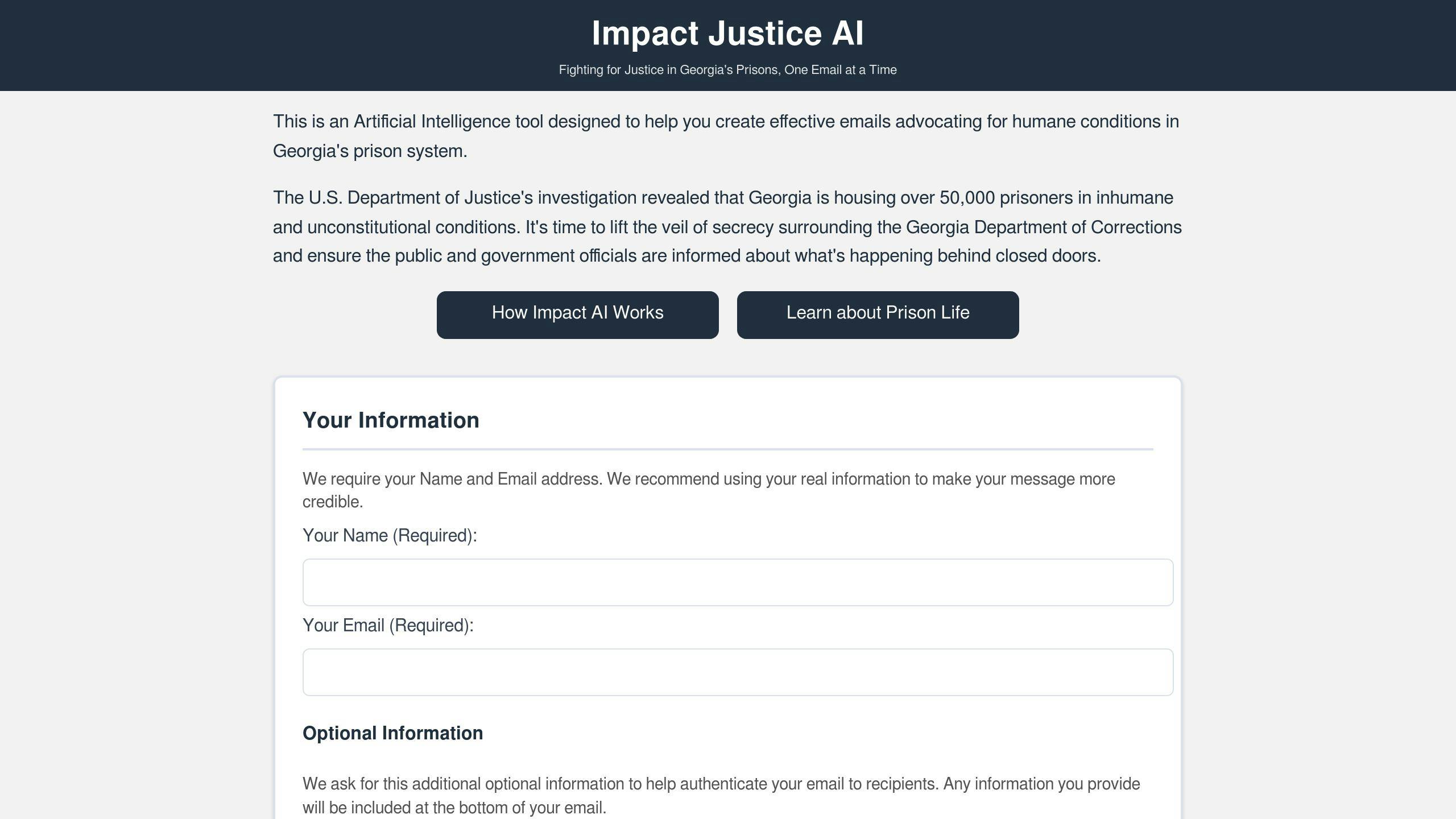

Advocating for better financial literacy programs requires effective tools, and Impact Justice AI steps in to help.

What Impact Justice AI Does

Impact Justice AI uses artificial intelligence to create evidence-based emails aimed at promoting financial literacy programs in Georgia’s prison system. It helps advocates influence policy changes and improve program implementation. By addressing challenges like limited funding and inconsistent program quality, the tool equips users with data-backed messaging to push for better resources and program expansion.

Here’s a quick look at its features:

| Feature | Purpose | How It Helps |

|---|---|---|

| Evidence Integration | Uses DOJ reports and research data | Backs up arguments with reliable sources |

| Topic Selection | Focuses on financial literacy initiatives | Targets specific program needs |

| Recipient Targeting | Connects with decision-makers and media | Reaches the right stakeholders |

| Customizable Messaging | Adjusts tone and content | Tailors the advocacy approach |

The platform also emphasizes the connection between financial education and lower recidivism rates.

Steps to Advocate with Impact Justice AI

1. Select Relevant Topics

Start by choosing "Financial Literacy in Prisons" as your main focus. Include evidence showing how financial education reduces recidivism and helps individuals reintegrate into society post-release.

2. Craft Your Message

Impact Justice AI helps create personalized, evidence-driven messages that resonate with decision-makers. Key points to include:

- Cost savings for the prison system

- Lower reoffending rates

- Improved financial stability for released individuals

- Better reintegration into the community

3. Target Key Decision-Makers

The tool provides contact details for:

- State legislators

- Prison system administrators

- Education program coordinators

- Media outlets covering prison reform

Using Impact Justice AI, advocates can effectively push for expanded financial education programs in Georgia prisons. This tool empowers users to drive meaningful change and improve financial literacy in correctional facilities.

Conclusion: Financial Education Reduces Repeat Offenses

Research from the University of Arkansas at Little Rock shows that financial literacy programs play a key role in lowering recidivism rates [4]. Examples from real-life programs and expert commentary highlight how these initiatives can create lasting change.

Collaborations with banks and other financial organizations, like 1st Security Bank‘s partnership with Washington Corrections Center for Women, show the value of external support. Joe Adams, CEO of 1st Security Bank, explains:

"We are honored to support inmates in rebuilding their lives and planning for post-release."

The lack of financial knowledge is particularly challenging for incarcerated individuals, making reentry into society even harder. Pennsylvania corrections officials John Wetzel and Robin L. Wiessmann point out:

"We have found that inmates too often do not have fundamental knowledge, skills, or experience to face the complex financial realities of life. Upon re-entry into society, too often they repeat poor financial decisions that helped put them on the path to incarceration."